Refinance Savings and Break-even - Should you refinance your mortgage? Use this calculator to determine what your new payment will be, how much you'll save in interest and when you will break even. Renter Affordability - Based on your current rent, find out how much of a mortgage you could afford.

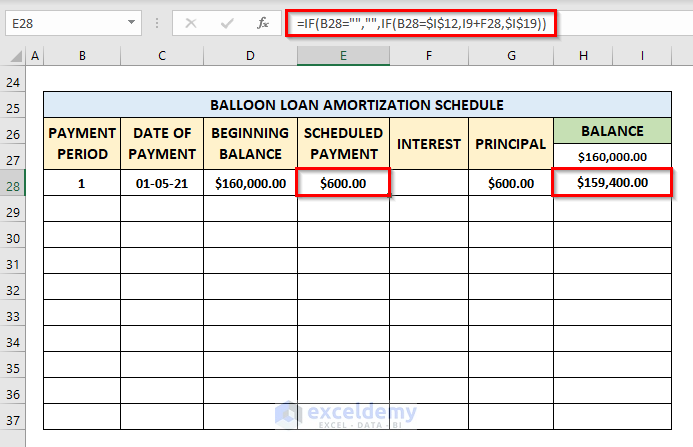

Buy - Factor in things such as interest, property taxes, tax savings, appreciation, opportunity costs, closing costs, and selling costs to see the real difference in renting versus buying. This calculator will calculate the monthly payments, the interest cost, and the balloon payment for any combination of balloon loan terms. Tax Savings for Renters - Find out how much someone currently renting can save in taxes this year if they decide to purchase a home. Balloon Loan Payment Calculator with Amortization Schedule and Optional Prepayment. Mortgage Tax Savings - Estimate the tax savings you'll realize by deducting interest and property tax payments.

Balloon mortgage calculator with amortization full#

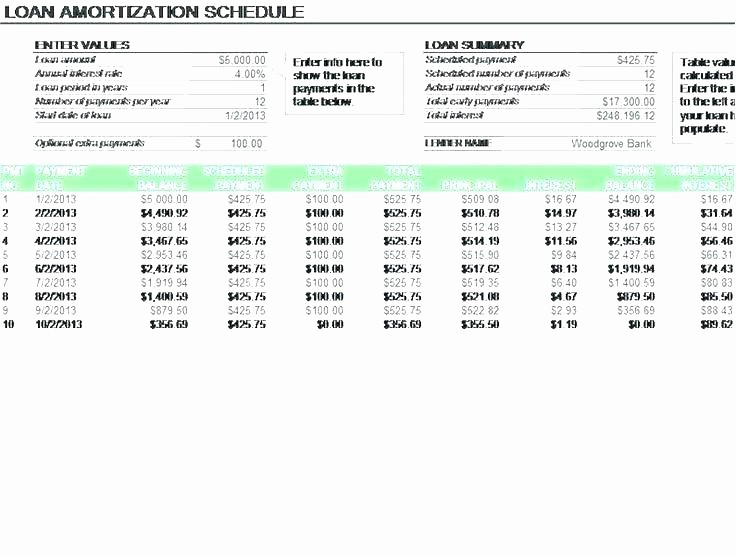

Mortgage Payoff - Save thousands of dollars in interest by increasing your monthly mortgage payment.īi-weekly Payments - Discover how much in interest you will save if you make 1/2 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. Balloon Payment Amortization Schedule: Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance Jun, 2023: 1: 343. Its usually thousands of dollars, so many borrowers opt to refinance the balloon amount at the end of the finance term. Its usually somewhere in the region of 30-40 of the vehicles value. Payment Range - Plug in a high and low figure for a payment and see how it translates to a mortgage. The balloon payment level can either be calculated as a dollar amount or it may be a standard percentage of the cars value/loan amount set by the lender. Mortgage Qualifier - Find out if you qualify for a given mortgage and just much you can afford, then create an amortization schedule. Interest Only - Compare monthly payment amounts for an interest-only mortgage and a principal-interest mortgage.Īdjustable Rate Mortgages - Determine monthly payments and the effective interest rate (APR) for an ARM.

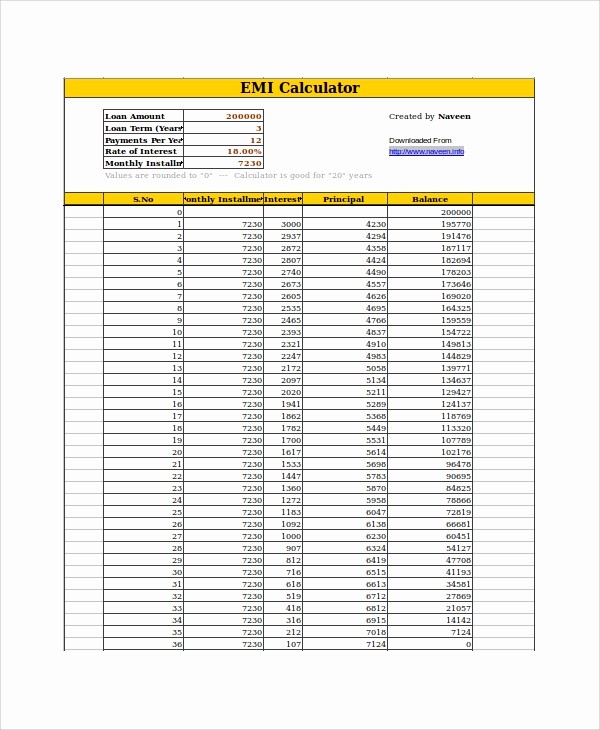

Annual interest rate / 12 monthly interest rate. Step 1: Convert the annual interest rate to a monthly rate by dividing it by 12. Mortgage APR - Find the APR on a fixed rate mortgage.īalloon Payment - A balloon mortgage can reduce your monthly payments but may require refinancing at the end of the term. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. For example, see the difference between a 15 year and a 30 year mortgage.Ĭompare Rates - See how changes in your rate affect your payment for a given principal and term. Whether you are a lender or the lessor, this template is helpful in making accurate projections and totals.Monthly Payment - Calculate your payment and amortization schedule.Ĭompare Terms - Compare multiple terms for a given principal and rate. Thus, whatever figure you type in will always come up with accurate data, allowing you to use this template as many times as you want anytime you have a balloon loan involved. This template already comes with built-in formula so the computations are automatic, leaving no room for miscalculations or mistakes. All you have to do is type in the information in the Assumptions and then see the figures automatically appear on the Key Financial Data portion. The Balloon Payment Excel Template is a wonderful tool for automatically calculating your financial data.

This information includes Loan Principal Amount, Annual Interest Rate, Amortization Period in Years, Years Until Balloon Payment. You input vital loan information in the Assumptions portion. This loan payment calculator template for Excel is divided into Assumptions and Key Financial Data. You can use this template to calculate your balloon payment loan. This can be helpful when you are still planning to make a loan, creating your monthly household budget, or is looking for a way to easily pay off your balloon loan. This loan payment template is compatible for Excel 2003 and later versions.

0 kommentar(er)

0 kommentar(er)